Imagine investing all your money in one stock. Sounds risky, right? Then why do so many of us rely solely on one source of income?

Listen up! I am going to say something controversial.

If your primary or - Jesus take the wheel - your sole source of income is from a job, then you are screwed. Like, royally screwed.

Your Job is NOT Safe

You see, your job is not safe, and your employer does not truly care about you. No matter how hard you work, how many sleepless nights, missed kid’s soccer games, or how many times you sacrifice working out or eating healthy to meet that deadline, your boss will still let you go the moment it suits them.

If that fact seems shocking to you, then pull your head out of your peach! This is a cold hard fact about corporate America. Sooner or later, almost all of us will experience a layoff, decrease in hours or pay, denial of a raise or promotion that we -know- that we deserve, or get fired outright.

When you derive most or all of your income from a job, you are exposing your financial wellbeing, hopes, dreams, and survival, to the whims of your corporate overlords. And often times, those in charge of your financial destiny, do not know your name, your story, or care to know these things about you. And when the proverbial financial shit hits the fan, they won't hesitate to let you go…just ask anyone in the tech industry.

I've been there too. I was 16, starting my first job at McDonalds, thinking I was on my way to financial nirvana, when a new Wendy's opened next door and the moms stopped bringing their little snot-nosed brats to our store for Happy Meals (complete with choking-hazard toy). Then with no warning I was told that my services were no longer needed and that my final check would come in the mail.

If you are saying "That cant happen to me, I don’t work in fast food," think again. It can happen to anyone. If you area a waiter, they cut you the second that the tables are no longer full. Delivery driver, gone as soon as the orders slow down. Construction worker, jobless as soon as the last nail is hammered in. Even white collar works are at risk these days. All of the tech giants are in the midst of layoffs, and if you think that’s bad, just wait until the AI revolution catches up with you "knowledge workers."

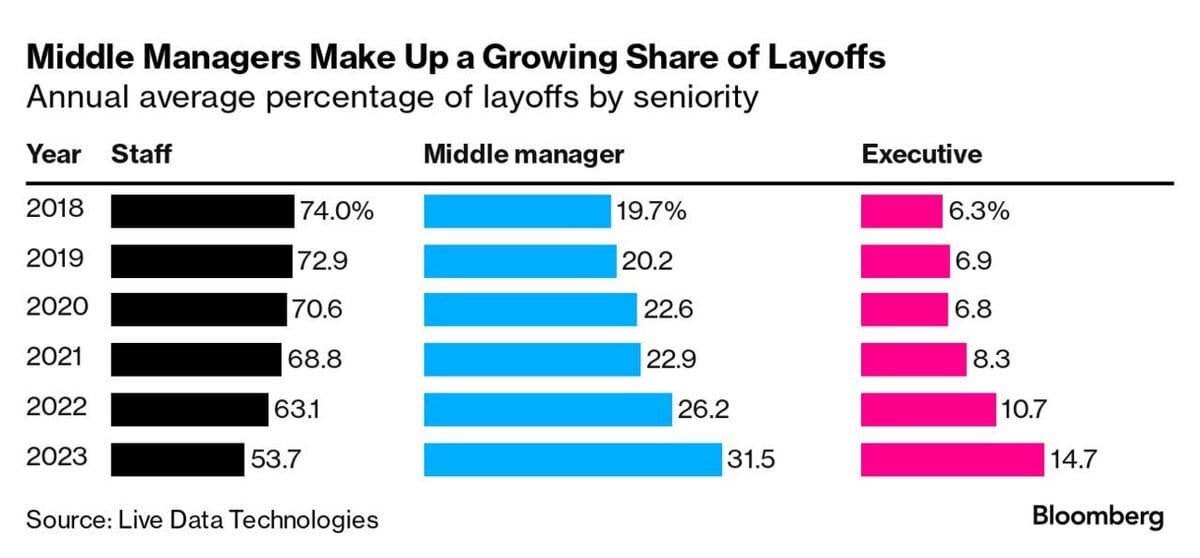

Middle Management Massacre and the Ghosts of RTO

Let's talk about a chilling trend in corporate America—chopping down middle management like it's a clearance sale at a Christmas tree farm. Giants like UPS and Citigroup aren't just trimming fat; they’re swinging the axe deep into the ranks of middle management, all in the name of 'efficiency.' And then there’s the sneaky beast of Return-to-Office (RTO) policies. Companies like AT&T, Google, and Amazon are getting slick with these policies, using them as a ninja move to slash headcounts. It’s like saying, "Sure, come back to the office... but only if you really want to keep your job." It’s a cost-cutting masquerade, tricking employees into quitting on their own, so these behemoths don’t have to dirty their hands with direct layoffs.

So what is one to do? Well you can turn to the word's oldest profession, but if you look like me, you'll probably starve to death. So for the rest of us, we need to generate multiple streams of income. That way, if one dries up, or if we are fired from our 9 to 5 job, we still have multiple other income sources to get us by until we can replace the income stream we lost.

This is where its important to understand the difference between the three income types: active, residual, and passive.

What the Hell is Passive Income Anyway?

Here's the deal: There are three flavors of income—active, residual, and passive. Active income is that paycheck you bust your ass for every week at your day job. Residual is cooler; it's money you earn down the line from work you did once—think royalties from that hit song you wrote in college (okay, or maybe just a jingle for a local car wash). Then there's passive income—the holy grail. This gem means you make money without lifting a finger. Think rental income from a property you own. While you're binging Netflix, your real estate is out there working for you, making money while you sleep. It’s the financial security blanket that says, "Lose your job? No problem, buddy, I got you covered."

“If you do not find a way to make money while you sleep, you will work until you die.”

-Warren Buffet

For most of us, time is a scarce commodity. That means that getting a second or third job is not an option, unless we forego sleep and tell our spouse and kids that it was nice knowing them. So then how do we create passive income streams? For most of us, real estate investing is the most direct and accessible way to create passive income streams that we maintain some control over, unlike stocks, bonds, and other Wallstreet investments.

Real Estate: Stability, Leverage, and Why You Should Care

Why real estate? Because it’s about as complicated as a LEGO set. Seriously, it’s one of the easiest ways to start pocketing passive income. You don’t need a boatload of cash or a PhD in economics. A little bit of savings for a down payment, a decent credit score, and you're all set to become the lord of some land (or at least a tiny apartment building). Plus, it’s tangible—you can see it, touch it, and feel damn proud of it. Real estate is your low-key, steady-Eddie friend in a world of high-strung, volatile investments.

Just ask CNBC…

First off, real estate is like that dependable friend who always shows up. It’s there, it’s stable, and it gives you cash month after month—not like those crazy stock market swings. Then there’s the magic of leverage—using other people’s money to amplify your own investment. Buy a property with 20% down, and you’re controlling 100% of the property. It's like supercharging your investment on someone else’s dime. And don’t get me started on tax perks. Depreciation, mortgage interest deductions, property tax write-offs—you get the drift. It’s making money while saving money. Lastly, diversification—because putting all your cash in one stock is like betting all your chips on red; it’s a rookie move. Real estate lets you spread out that risk, giving you a safety net that keeps you snug when the job market goes belly up.

How to Kickstart Your Diversification Engine

Wanna get into real estate but scared of turning into some slumlord? Start small. Multifamily properties are your entry ticket. They offer several rent checks each month, which means you’re not screwed if one tenant dips. And hey, I've got just the thing to get you rolling—a "Small Multifamily Property Analysis" course. It’s packed with easy-to-digest info and a killer deal evaluation tool that won’t make your head explode. It’s your first step towards not being at the mercy of your boss or a shaky economy. Let's get that money working for you.

Wrapping This Up

Alright, let’s land this plane. Banking on just your job for income is like trusting a cat to watch your goldfish. Not the smartest move. Diversifying with real estate? Now we’re talking. It’s stable, it’s leveraged, and it damn sure beats the panic of job hunting when you’re unexpectedly axed. So what are you waiting for? Dive into the real estate game and start building that empire, one rental check at a time. Let’s move beyond just surviving and start thriving. Your financial independence is calling—pick up the damn phone!